- Home

- CIMA

- F3 Financial Strategy

- CIMA.F3.v2023-12-11.q105

- Question 1

Join the discussion

Question 1/105

Company X is based in Country A, whose currency is the A$.

It trades with customers in Country B, whose currency is the B$.

Company X aims to maintain its revenue from exports to Country B at 25% of total revenue.

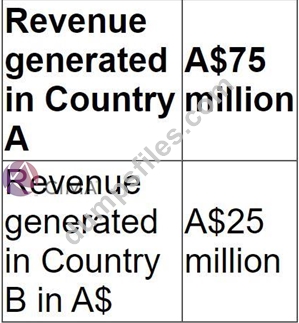

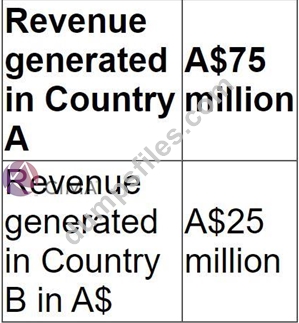

Company A has the following forecast revenue:

The forecast revenue from Country B has assumed an exchange rate of A$1/B$2, that is A$1 = B$2.

If the B$ depreciates against the A$ by 10%, the ratio of revenue generated from Country B as a percentage of total revenue will:

It trades with customers in Country B, whose currency is the B$.

Company X aims to maintain its revenue from exports to Country B at 25% of total revenue.

Company A has the following forecast revenue:

The forecast revenue from Country B has assumed an exchange rate of A$1/B$2, that is A$1 = B$2.

If the B$ depreciates against the A$ by 10%, the ratio of revenue generated from Country B as a percentage of total revenue will:

Correct Answer: D

Add Comments

- Other Question (105q)

- Q1. Company X is based in Country A, whose currency is the A$. It trades with customers in Cou...

- Q2. Which THREE of the following would be of most interest to lenders deciding whether to prov...

- Q3. A company's Board of Directors is considering raising a long-term bank loan incorporating ...

- Q4. A listed company is planning a share repurchase. The following data applies: * There are 1...

- Q5. A listed company plans to raise $350 million to finance a major expansion programme. The c...

- Q6. The financial assistant of a geared company has prepared the following calculation of the ...

- Q7. Company Z has just completed the all-cash acquisition of Company A. Both companies operate...

- Q8. A company is considering the issue of a convertible bond compared to a straight bond issue...

- Q9. A company wishes to raise new finance using a rights issue. The following data applies: * ...

- Q10. Company X plans to acquire Company Y. Pre-acquisition information: (Exhibit) Post-acquisit...

- Q11. A company is planning a new share issue. The funds raised will be used to repay debt on wh...

- Q12. Using the CAPM, the expected return for a company is 11%. The market return is 8% and the ...

- Q13. Company A has just announced a takeover bid for Company B. The two companies are large com...

- Q14. A consultancy company is dependent for profits and growth on the high value individuals it...

- Q15. RST wishes to raise at least $40 million of new equity by issuing up to 10 million new equ...

- Q16. A listed company plans to raise new capital which will be required for future investment p...

- Q17. Company C is a listed company. It is currently considering the acquisition of Company D. T...

- Q18. A company is currently all-equity financed with a cost of equity of 8%. It plans to raise ...

- Q19. Company Z wishes to borrow $50 million for 10 years at a fixed rate of interest. Two alter...

- Q20. A company's current earnings before interest and taxation are $5 million. These are expect...

- Q21. M is an accountant who wishes to take out a forward rate agreement as a hedging instrument...

- Q22. The Board of Directors of a small listed company engaged in exploration are currently cons...

- Q23. A listed publishing company owns a subsidiary company whose business activity is training....

- Q24. At the last financial year end, 31 December 20X1, a company reported: (Exhibit) The corpor...

- Q25. Which of the following best explains why the interest rate parity model is highly effectiv...

- Q26. G purchased a put option that grants the right to cap the interest on a loan at 10.0%. Sim...

- Q27. A listed company plans to raise $350 million to finance a major expansion programme. The c...

- Q28. RST wishes to raise at least $40 million of new equity by issuing up to 10 million new equ...

- Q29. An unlisted company wishes to obtain an estimated value for its shares in anticipation of ...

- Q30. DFG is a successful company and its shares are listed on a recognised stock exchange. The ...

- Q31. A company plans to raise $12 million to finance an expansion project using a rights issue....

- Q32. Company AAB is located in country A whose currency is the AS It has a subsidiary, BBA, loc...

- Q33. A company has 6 million shares in issue. Each share has a market value of $4.00. $9 millio...

- Q34. Company YZZ has made a bid for the entire share capital of Company ZYY Company YZZ is offe...

- Q35. A Venture Capital Fund currently holds a significant shareholding in a large private compa...

- Q36. Two listed companies in the same industry are joining together through a merger. What are ...

- Q37. A company has forecast the following results for the next financial year: The following is...

- Q38. A company has announced a rights issue of 1 new share for every 4 existing shares. Relevan...

- Q39. A venture capitalist invests in a company by means of buying: * 9 million shares for $2 a ...

- Q40. A company's main objective is to achieve an average growth in dividends of 10% a year. In ...

- Q41. Company A is a large well-established listed entertainment company and Company B is a smal...

- Q42. An unlisted company which is owned and managed by its original founders has accumulated ex...

- Q43. MAN is a manufacturing company that is based in country M and sells almost exclusively to ...

- Q44. Company J is in negotiations to acquire Company K and believes it can turn around Company ...

- Q45. A company has forecast the following results for the next financial year: The following is...

- Q46. An all equity financed company plans an issue of new ordinary shares to the general public...

- Q47. A listed company follows a policy of paying a constant dividend. The following information...

- Q48. A company is currently all-equity financed with a cost of equity of 9%. It plans to raise ...

- Q49. The primary objective of a public sector entity is to ensure value for money is generated....

- Q50. A company generates operating profit of $17.2 million, and incurs finance costs of $5.7 mi...

- Q51. A company is reporting under IFRS 7 Financial Instruments: Disclosures for the first time ...

- Q52. Company B is an all equity financed company with a cost of equity of 10%. It is considerin...

- Q53. A company's dividend policy is to pay out 50% of its earnings. Its most recent earnings pe...

- Q54. A company needs to raise $20 million to finance a project. It has decided on a rights issu...

- Q55. Company X is based in Country A, whose currency is the A$. It trades with customers in Cou...

- Q56. Company A plans to acquire Company B, an unlisted company which has been in business for 3...

- Q57. Company A operates in country A with the AS as its functional currency. Company A expects ...

- Q58. A company has an opportunity to invest in a positive net present value project, but the pr...

- Q59. For which THREE of the following risk categories does IFRS 7 require sensitivity analysis?...

- Q60. Select the most appropriate divided for each of the following statements: (Exhibit)...

- Q61. The directors of the following four entities have been discussing dividend policy: (Exhibi...

- Q62. A UK based company is considering investing GBP1 ,000,000 in a project it the USA. It is a...

- Q63. Company X is based in Country A, whose currency is the A$. It trades with customers in Cou...

- Q64. Which THREE of the following statements are correct in respect of the issuance of debt sec...

- Q65. ZZZ is a listed company based in Brinland. a European country. It is the largest owner and...

- Q66. Holding cash in excess of business requirements rather than returning the cash to sharehol...

- Q67. A company is funded by: * $40 million of debt (market value) * $60 million of equity (mark...

- Q68. Company B is an all equity financed company with a cost of equity of 10%. It is considerin...

- Q69. Extracts from a company's profit forecast for the next financial year as follows: (Exhibit...

- Q70. A company proposes to value itself based on the net present value of estimated future cash...

- Q71. A company is concerned about the interest rate that it will be required to pay on a planne...

- Q72. The ex div share price of Company A's shares is $.3.50 An investor in Company A currently ...

- Q73. The following information relates to Company A's current capital structure: Company A is c...

- Q74. Company A is located in Country A, where the currency is the A$. It is listed on the local...

- Q75. A company has: * $6 million market value of equity * $4 million market value of debt * WAC...

- Q76. A company is considering taking out $10.000,000 of floating rate bank borrowings to financ...

- Q77. JAG and ZEB are two listed companies. JAG is approximately 20 times the size of ZEB. 10 da...

- Q78. Company B is an all equity financed company with a cost of equity of 10%. It is considerin...

- Q79. Company ABC's management has noticed that Company BCD has quickly built up a 20% stake by ...

- Q80. A company plans to raise finance for a new project. It is considering either the issue of ...

- Q81. A company's main objective is to achieve an average growth in dividends of 10% a year. In ...

- Q82. A company is considering hedging the interest rate risk on a 3-year floating rate borrowin...

- Q83. Listed company R is in the process of making a cash offer for the equity of unlisted compa...

- Q84. Which THREE of the following are likely to be strategic reasons for a horizontal acquisiti...

- Q85. A venture capitalist invests in a company by means of buying: * 9 million shares for $2 a ...

- Q86. Company T is a listed company in the retail sector. Its current profit before interest and...

- Q87. Company M's current profit before interest and taxation is $5.0 million. It has a long-ter...

- Q88. A listed company is financed by debt and equity. If it increases the proportion of debt in...

- Q89. A wholly equity financed company has the following objectives: 1. Increase in profit befor...

- Q90. A large, listed company in the food and household goods industry needs to raise $50 millio...

- Q91. A company wishes to raise new finance using a rights issue to invest in a new project offe...

- Q92. A company has 8% convertible bonds in issue. The bonds are convertible in 3 years time at ...

- Q93. A company is wholly equity funded. It has the following relevant data: * Dividend just pai...

- Q94. Company A, a listed company, plans to acquire Company T, which is also listed. Additional ...

- Q95. Company X plans to acquire Company Y. Pre-acquisition information: (Exhibit) Post-acquisit...

- Q96. XYZ has a variable rate loan of $200 million on which it is paying interest of Liber ' 3%....

- Q97. Extracts from a company's profit forecast for the next financial year as follows: (Exhibit...

- Q98. Company A is unlisted and all-equity financed. It is trying to estimate its cost of equity...

- Q99. A company's annual dividend has grown steadily at an annual rate of 3% for many years. It ...

- Q100. A company has: * A price/earnings (P/E) ratio of 10. * Earnings of $10 million. * A market...

- Q101. A company is considering a divestment via either a management buyout (MBO) or sale to a pr...

- Q102. Company C invests heavily in Research and Development an need to raise $45 million to fina...

- Q103. Company C has received an unwelcome takeover bid from Company P. Company P is approximatel...

- Q104. Company M plans to bid for Company J. Company M has 20 million shares in issue and a curre...

- Q105. A company aims to increase profit before interest and tax (PBIT) each year. The company re...